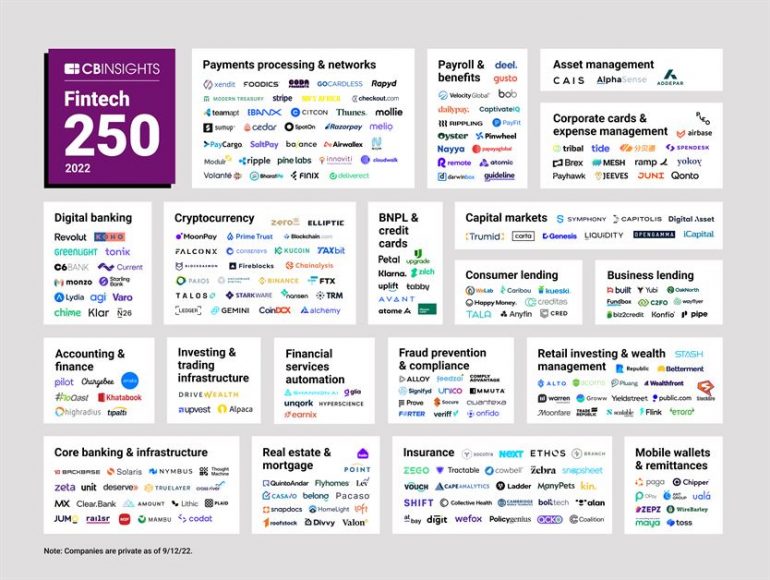

May has recently entered CB Insights‘ Fintech 250 ranking, which showcases the 250 most promising private fintech companies of 2022. The all-on-one money platform joins an elite roster which includes digital banks N26 and Revolut, PayPal-backed payment processor Stripe, merchant platform Pine Labs, and Binance.

The citation is in recognition of Maya’s strong record of execution as the only platform with a top-rated all-in-one money app, leading merchant payments processor business, the most extensive MSME on-ground network, and the fastest growing digital bank in the Philippines.

“We are proud to be recognized alongside other trailblazers in the global fintech space. Being on this list validates our thrust of providing an integrated experience to our customers through our comprehensive digital financial ecosystem. It is also a testament to the world-class organization that we’ve built.”

– Shailesh Baidwan, Maya Group President and Maya Bank Co-Founder

“This year’s Fintech 250 winners are shaping the future of financial services, from payments and banking to investing and insurance. Representing more than 30 countries, these companies are creating safer and more efficient payment methods and transforming how traditional banking, insurance, and investing products are delivered.”

– Brian Lee, SVP of CB Insights’ Intelligence Unit

How Maya Was Selected

Maya was selected from a pool of over 12,500 private companies, including applicants and nominees. winners were chosen based on factors which include R&D activity, proprietary Mosaic scores, market potential, business relationships, investor profile, news sentiment analysis, competitive landscape, team strength, and tech novelty.

Since its transformation from PayMaya, the company has expanded beyond payments, introducing game-changing digital banking innovations across its unique ecosystem of 51 million consumers and a network of 1.2 million MSMEs.

Just three months after its launch, Maya Bank became the world’s fastest-growing digital bank in the Philippines, recording over PHP5 billion in deposit balance and over 650,000 bank customers. It’s also the only digital bank to offer loan products within a quarter from launch.

In March 2022, Maya, through its parent company, Voyager Innovations, became the second tech unicorn in the Philippines, backed by global investors, including KKR, Tencent, International Finance Corporation, IFC Financial Institutions Growth Fund, SIG Venture Capital, EDBI, First Pacific Company, and PLDT.

Emman has been writing technical and feature articles since 2010. Prior to this, he became one of the instructors at Asia Pacific College in 2008, and eventually landed a job as Business Analyst and Technical Writer at Integrated Open Source Solutions for almost 3 years.