BPI recently unveiled Track and Plan, a first-in-the-industry feature for its new app. This AI-assisted tool can analyze and track your financial activities on the BPI app, and share insights on your spending habits, while also offering suggestions for smarter financial investments.

What is Track and Plan?

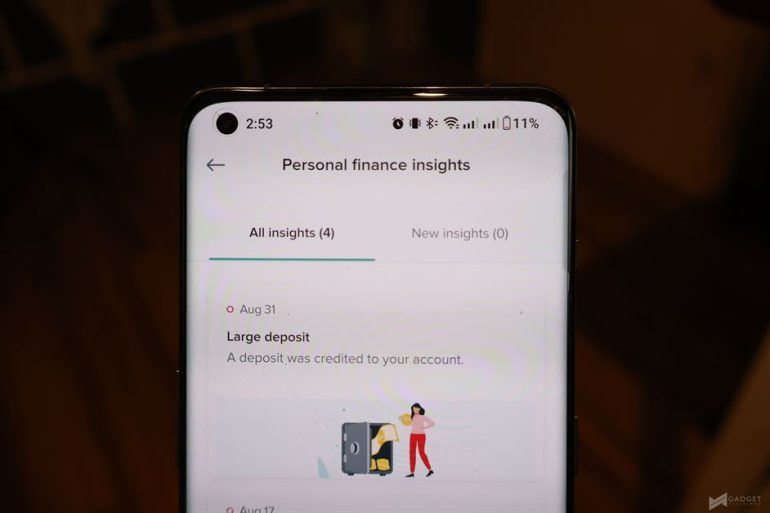

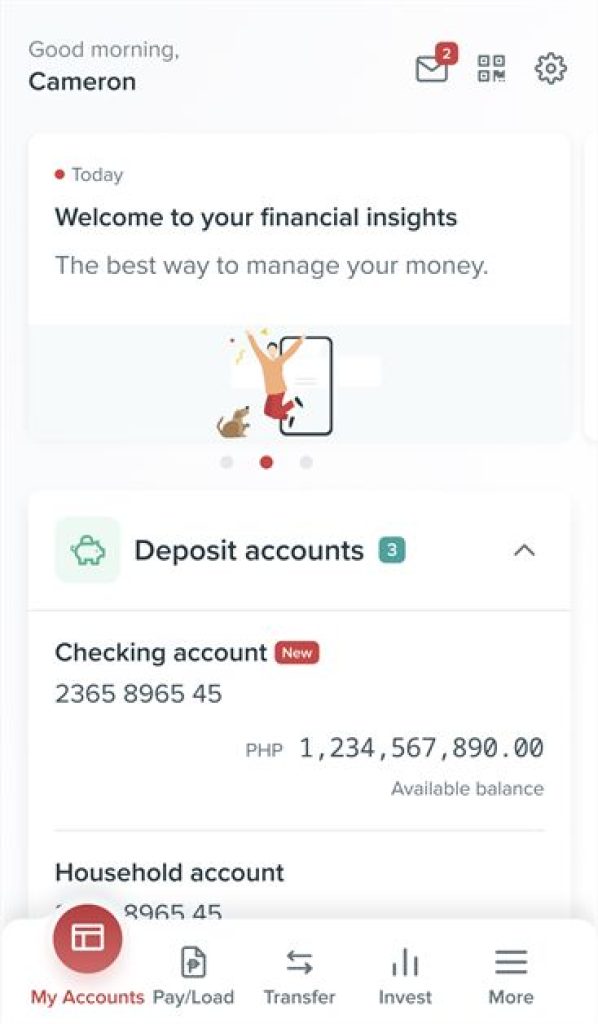

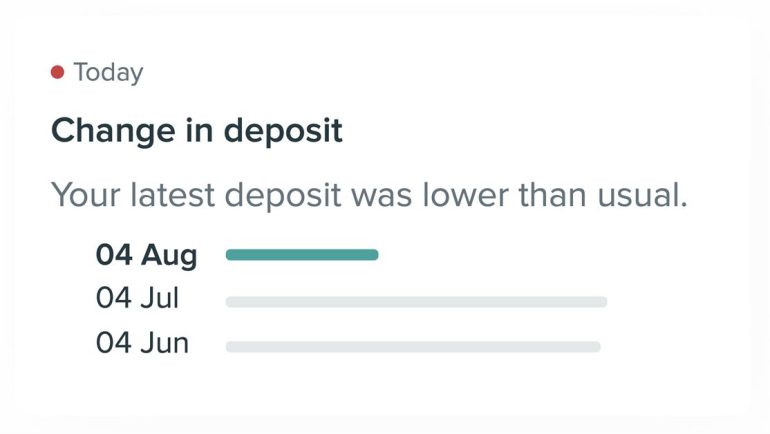

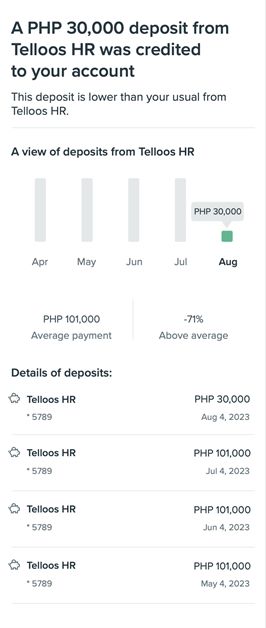

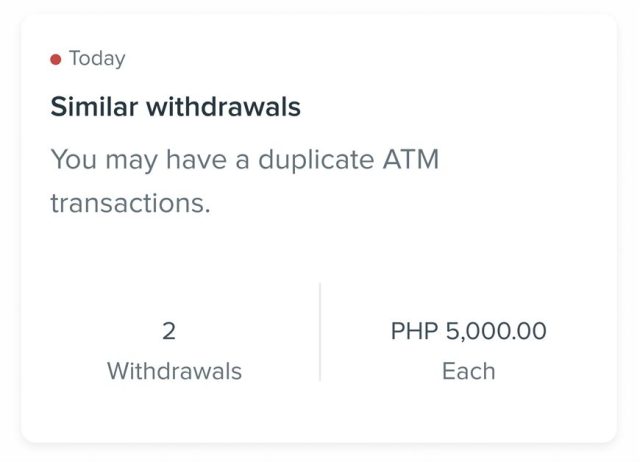

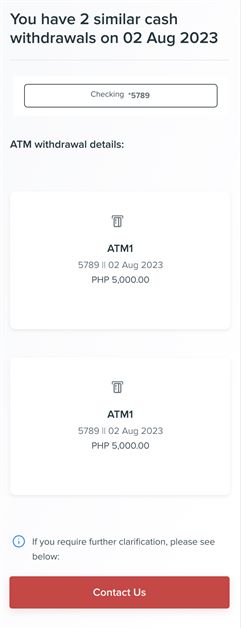

If you’ve been using the new BPI app, you may have already noticed the various insights that appear at the top section. Track and Plan generates these interactive cards based on your transactions.

You’ll get notified say, when there’s a back-to-back withdrawal made, when there’s unexpected changes to deposits, or when there’s a large amount that was deposited to your account, among other scenarios.

Track and Plan can also suggest ways on how you can invest and grow your extra funds and alert you when your bill amounts are higher than the usual.

These insights are only available for your viewing, and BPI assures the privacy of your financial transactions.

“I have been covering the financial industry for decades and I have never seen a banking app that acts like a financial advisor with powerful access to tools that allow anyone to move from knowledge to action. Let’s face it, most of us get offended when someone tells us we are spending too much, but with Track and Plan, it’s like you telling you! So our emotional human experience gets a big jolt of logic — and that could be transformational in bringing our country’s savings rate higher.”

– Veteran Journalist and ‘Financial Beshie ng Bayan’ Salve Duplito

“We at BPI are excited to unveil Track and Plan, our AI-powered personal finance management tool on the new BPI app. We are leveraging technology to simplify money management to empower Filipinos to do more and make their lives better every day. This feature essentially scales BPI’s seasoned and personalized financial advice to millions of Filipinos and is the next step forward in BPI’s evolution. Our customers can look forward to more in-depth insights and actionable advice as we continue to develop this feature.”

– Mariana Zobel de Ayala, Consumer Marketing and Platforms Head at BPI

As the AI learns from your usage pattern, the more you use it, the better insights you’ll get from Track and Plan. In its pursuit of improving overall experience for its customers, BPI is set to expand its capabilities in the coming months. Eventually, users will be able to enable automatic monthly investments, schedule their most frequent transactions, and get access to a budget-tracker, all exclusively on the new BPI app.

The old BPI app is set to be phased out on September 30, 2023. You can download the new BPI App for iOS and Android. Transitioning is seamless. Just use the same login details that you use on the old app for the new app.

Emman has been writing technical and feature articles since 2010. Prior to this, he became one of the instructors at Asia Pacific College in 2008, and eventually landed a job as Business Analyst and Technical Writer at Integrated Open Source Solutions for almost 3 years.