Financial technology or fintech has been on the rise in the Philippines and has picked up even more after the COVID-19 pandemic. We’re now in 2023 and it’s almost a norm to pay with your e-wallet like GCash and Maya (formerly PayMaya).

GCash and Maya may have started as e-wallets but both have since expanded their services to offer a savings account. GCash has done so by partnering with CIMB, BPI, Maybank, and UNO Digital Bank, while Maya has rebranded and registered as a digital bank on its own. In addition to offering a savings account, both companies have also interestingly offered loans and credit.

We know how difficult it is to get a credit card or loan especially if you’re doing it for the first time and without a bank account of your own. So, we definitely appreciate companies like GCash and Maya offering these services without leaving the house.

With that said, what are the processes for applying for a personal loan in both Maya and GCash? And what are the limitations that you’ll come across? Is one better than the other? We wondered as well and this is why we’ve decided to put together a look into these.

We’re aware that there are other loan applications but we decided to narrow it down to Maya and GCash because these are also the most used e-wallets.

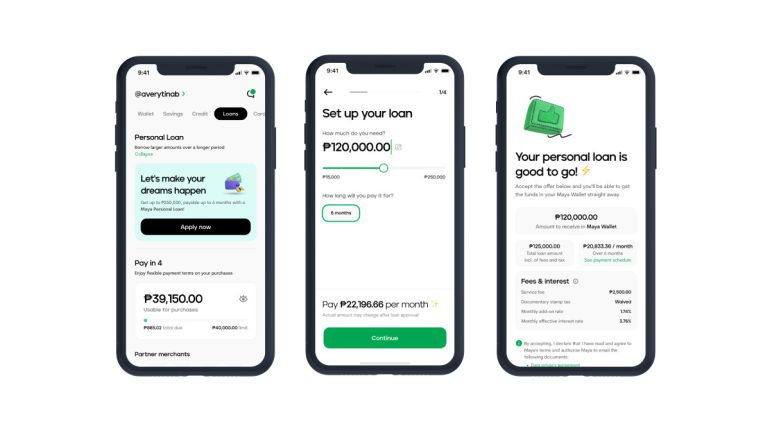

Maya Personal Loan Application Process

Maya offers a personal loan, which according to its FAQ can go as much as PHP 250,000 with flexible installment terms of up to 24 months. Once approved, it will be sent to your Maya Wallet.

Personal Loan is different from Maya Credit which, instead, offers a 30-day virtual credit line of up to PHP 18,000. The transactions made within the billing period must be fully settled on the next due date. These are also different from Maya Pay in 4 which lets you pay for goods and services in a total of 4 installments due every 2 weeks.

In order to qualify for a Personal Loan, you’ll need to be:

- At least 21 to 65 years old

- A Filipino resident

- Have an upgraded Maya account

- Been actively using Maya account for your transactions

Here’s how you can apply:

- Open the Loans dashboard on the Maya app

- Tap “Apply for a Loan” on the Maya Personal Loan banner

- View the introduction screen and tap “Continue”

- Enter your loan details in the loan calculator screen

- Enter and validate your personal information then tap “Submit”

- After reviewing your loan offer that includes loan amount, interest rate, and repayment terms, tap “Accept”

- Enter the One-Time Pin (OTP) sent to your mobile number to authorize the loan

You will have to disclose information to Maya throughout the loan application process. This includes your take-home pay, nature of work, source of income, purpose for the loan, and civil status.

There are also zero service fees when applying for a Personal Loan and the documentary stamp tax is waived as well. It also has a monthly add-on rate as low as 0.83% with an effective interest rate of 1.40% per month although this will be provided to you upon application.

Failure to pay for your loan on time will result in a late penalty fee equivalent to 0.17% of your unpaid principal amount per day until the due amount is fully settled.

As far as payments go, you can do so via the Maya app by tapping ‘Pay bills’ and selecting ‘Maya Bank’. You can also pay via the nearest Maya Center. The latter will post your payment within three business days.

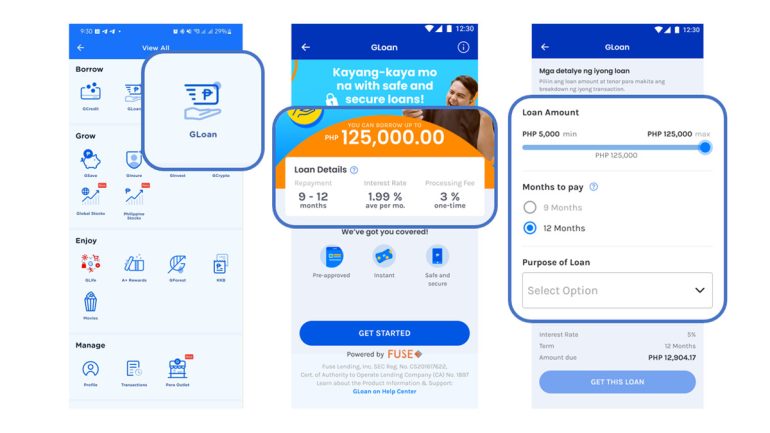

GCash – GLoan Application Process

GCash, on the other hand, has GLoan, powered by Fuse Lending, which offers up to PHP 125,000 with payment terms of up to 24 months. You can also re-apply for a loan in 4-7 days after the initial loan is fully paid. Once approved, the loan will be added to your GCash wallet within 24 hours after applying.

Like Maya, GLoan is entirely different from GCredit. The latter offers up to PHP 30,000 with a payment term of 45 days. These also differ from GGives that allows you to defer your payment for purchase for up to 24 months.

To be eligible for a GLoan, you’ll need to meet all the respective requirements:

- 21-65 years old

- Filipino citizen

- Fully verified GCash account

- Good credit record and did not commit any fraudulent transactions

- Maintain a good GScore

The company clarifies that if GLoan is unavailable for you, it could be because you did not meet the requirements or it isn’t available for your account or you still have an existing GLoan.

Here are the steps to apply for the loan:

- Tap ‘Borrow’ on the GCash app

- Tap “GLoan” (if available)

- Tap “Get Started”

- Input your loan amount, select your Purpose of Loan, then tap Get this Loan

- Review your loan terms then tap “Continue”

- Review your personal information then tap “Next”

- Agree to the Data Privacy Agreement, then tap “Submit”

- Agree to the Loan Agreements, then tap “Continue”

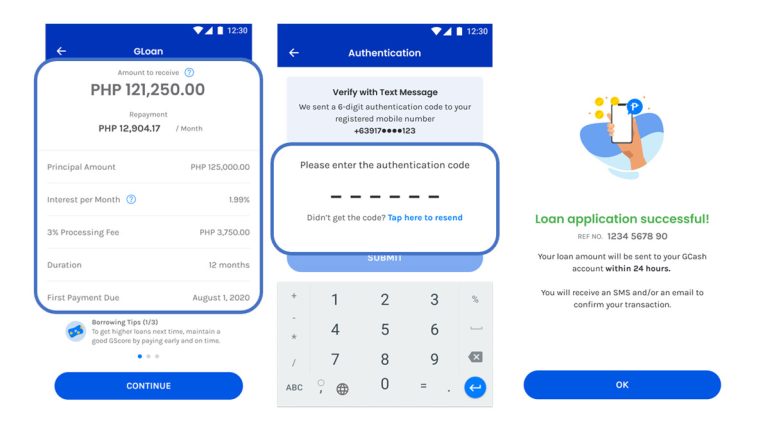

- Check the amount you will receive from GCash, then tap “Confirm”

Similar to Maya though, you won’t need to turn in documentation for the application process as you would traditionally. You will have to input your information though like your purpose for the loan, your address, birth date, to name a few.

Interest rates for GLoan will depend on your GScore and it can go from 1.59% – 6.57% per month. You will also be charged a 3% processing fee which will be deducted to disbursement.

Payments can be made via the GCash app itself or via GCash payment partners, among these include BPI, Bayad Center, Metrobank, and BDO. If you aren’t able to pay your dues on time, you will incur a late payment fee of 1% of your loan amount for each unpaid installment plus 0.15% of your outstanding principal balance per day until you pay off your due. It will also lower your GScore.

However, if you fully pay off your loan at least one month before your last installment’s due date, you are entitled to receive interest cashback.

Maya Personal Loan vs GLoan Quick Comparison

| Maya Personal Loan | GLoan | |

| Maximum Amount | PHP 15,000 to PHP 250,000 | up to PHP 125,000 |

| Interest Rate | as low as an effective rate of 1.40% per month | as low as an effective rate of 1.59% per month |

| Installment Duration | 6 months | 5,9,12,15, 18, 24 months |

| Processing Time | Instant approval after submitting the loan application | Instant approval (pre-approved loans) |

| Service Fee | 0 service fees + waived Documentary stamp tax | 3% processing fee of your total loan amount |

| Late Penalty Fees | equivalent of 0.17% of unpaid amount per day until amount is fully settled | 1% of your loan amount for each unpaid installment + 0.15% of total outstanding principal balance will be charged per day until dues are paid |

Maya Personal Loan or GLoan, Is There A ‘Winner’?

Now that we’ve taken a look at the processes, interest rates, and all of both Maya Personal Loan and GLoan, we can go back to the question, is one better than the other?

On one hand, Maya Personal Loan has a larger cap amount for the loan as well as zero service fees. While on the other, GLoan offers a longer duration for the loan with up to a max of 24 months, which definitely makes it lighter to pay for the loan monthly.

However, at the end of the day, it will depend on which of the two apps you use more as it will help you get your loan approved and a lower interest rate.

So who’s the real winner here? I think we, the consumer are the winners.

We are no longer tied to traditional banks to get loans and credit. Traditional banks require you to set a schedule to visit your preferred bank, and that’s even assuming you have a preferred one, and get all the documents you need, without an idea if you will get the loan or not.

In comparison, apps like GCash and Maya offer loans that you can apply for while you’re still at work or without leaving your home if you meet the requirements. They also do this without the immediate need for documents which sometimes is the main problem for people.

Although these loans aren’t as high as traditional banks can offer, Maya Personal Loan or GLoan, or similar app-based loans are enough to cover personal emergencies or when you just need that extra boost of funds like when you need to upgrade your gear.

What’s more, all you need are the Maya or GCash apps to receive the loans as opposed to opening a bank account to receive the amount and then withdrawing the cash from the account. If you’re already eligible to apply for a loan from either Maya or GCash, that means you have the app and have used it enough, adding just an added layer of convenience.

The growth of fintech in the Philippines has definitely made saving and applying for loans easier, especially for those that are just getting started or those without a bank account. And as a consumer, having more options will always be a win for us.

Ram found his love and appreciation for writing in 2015 having started in the gaming and esports sphere for GG Network. He would then transition to focus more on the world of tech which has also began his journey into learning more about this world. That said though, he still has the mentality of "as long as it works" for his personal gadgets.